1. The Golden Hook: The 4.4% Ticking Clock

The headlines are unmistakable, but the investment implication is often missed. The Emirate of Dubai has officially reported a robust 4.4% GDP growth in the first half of 2025—a figure that stands out as one of the strongest economic performances across the GCC. While this statistic confirms Dubai’s position as a global economic powerhouse, for real estate investors, it signifies something far more critical: the immediate end of current pricing.

Economic data doesn’t translate into property prices overnight; it operates on a lag. Historically, major GDP upticks are absorbed by the market, resulting in significant capital appreciation within a tight 6 to 12-month window. We are standing precisely at the beginning of that window. The property you can acquire today at the AED 2 Million Golden Visa threshold will not be available at the same price tomorrow. This is not a long-term forecast; it is an imminent call to action.

The opportunity to buy a Golden Visa-eligible property before the economic boom fully registers in valuation is a fleeting one. The clock is ticking, and the time to move from research to acquisition is now.

2. The Data Deep Dive: Dynamics Impacting Golden Visa Property Prices

To understand the urgency, one must look beyond the 4.4% headline and examine the sectors driving this growth, as detailed in recent economic reports.

A. Sector-Specific Drivers Fueling Real Estate

The growth is disproportionately led by sectors that create affluent demand for housing and commercial space, a finding which is validated by the [Report of Dubai Real Estate Market Q2 2025].

- Real Estate and Financial Services: Direct growth in these sectors validates market stability and investor confidence.

- • Construction: While construction activity is high, it is focused on major infrastructure and large-scale projects. Read our analysis on [Top New Dubai Projects for 2025].

- Healthcare and Education: Significant government investment in these areas is attracting highly paid expatriate professionals, further intensifying rental and purchase demand in specific neighborhoods.

B. The Imbalance: Why Golden Visa Investment Cannot Wait

This specific delivery timeline creates the core of the 2025 opportunity. High GDP growth attracts global wealth and corporate migration, increasing demand instantly. However, the physical supply needed to absorb this new influx is still under development.

- Current Reality: High occupancy rates and soaring rental prices are already reflecting the scarcity of immediate supply.

- Near-Term Projection: As the economic momentum from the 4.4% GDP figure filters through, the limited existing inventory will be quickly purchased, pushing all asset classes higher.

This fundamental imbalance—Immediate, high-powered demand meeting Delayed supply—is the ironclad guarantee that property prices will jump, making immediate investment the only way to lock in today’s lower valuations.

3. The Double Threat of the Golden Visa Investment

The Golden Visa program is the single most powerful incentive for immediate action, not only because it offers long-term residency but because its conditions are currently under threat of becoming more restrictive.

A. The Price Timeline: Loss of Capital on Golden Visa Property

Ignoring the market’s expected appreciation is equivalent to guaranteeing a capital loss before you even invest.

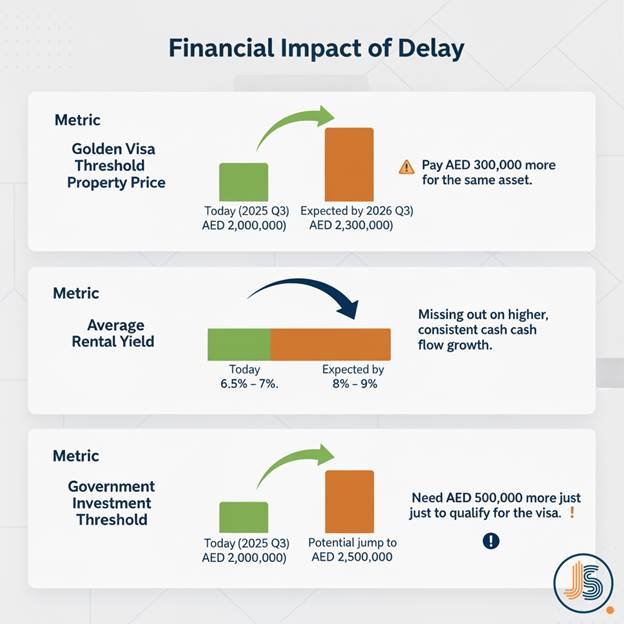

| Metric | Today (2025 Q3) | Expected by 2026 Q3 | Financial Impact of Delay |

| Golden Visa Threshold Property Price | AED 2,000,000 | AED 2,300,000 | Pay AED 300,000 more for the same asset. |

| Average Rental Yield | 6.5% – 7% | 8% – 9% | Missing out on higher, consistent cash flow growth. |

| Government Investment Threshold | AED 2,000,000 | Potential jump to AED 2,500,000 | Need AED 500,000 more just to qualify for the visa. |

B. Policy Risk: Lock in the AED 2 Million Threshold Today

The most potent motivator is the risk of policy change. Governments periodically review their residency-by-investment programs to maintain exclusivity and capital requirements in line with economic prosperity. Given the substantial 4.4% GDP surge, it is highly likely that Dubai will seek to raise the investment bar for the Golden Visa from AED 2 Million to AED 2.5 Million to filter applications and maximize the capital injected into the economy.

For the investor: Acquiring a property under the existing AED 2 Million threshold today allows you to lock in the current, lower entry price while still securing the coveted long-term residency benefits—a strategic advantage that may vanish by early 2026. This is the definition of FOMO (Fear of Missing Out) driven by legitimate economic and political forces.

4. Where Smart Money is Moving: Targeted Strategy for Golden Visa Location Investment

Successful real estate investment is not about buying any property; it’s about buying the right property in the areas benefiting most from the 4.4% economic expansion. The focus should be on the right property. Discover more on here

A. Healthcare Corridors: Golden Visa Rental Powerhouses

The expansion of Dubai’s medical and healthcare infrastructure creates unprecedented demand for mid- to high-end residential units near new hospital and clinic districts. These areas offer stability and predictable rental streams from medical professionals, leading to higher-than-average yields. Focus on properties near announced hospital projects or major healthcare free zones.

B. Construction & Commercial Hubs: Yield Maximization

Established commercial areas that are still seeing high levels of new construction completion, such as Business Bay, continue to deliver the highest short-term rental yields, often exceeding 8%. These areas attract young professionals and corporate residents who prefer modern, centrally located homes, guaranteeing low vacancy rates.

C. Finance Zones: Premium Rental Appreciation

The continued strategic expansion of zones like the DIFC (Dubai International Financial Centre) is cementing Dubai’s role as the financial capital of the region. Investment in adjacent premium residential buildings caters to top-tier banking and finance executives, ensuring both premium rental income and consistent capital growth due to the scarcity of prime central property.

5. The 90-Day Action Plan: From Decision to Residency

The journey to becoming a Dubai property owner and Golden Visa holder is streamlined when you have the right guidance. We condense the perceived complexity into a simple, actionable three-month plan:

| Timeline | Milestone & Action | Outcome & Benefit |

| Month 1 | Property Identification & Due Diligence | Identify the ideal property (under AED 2M) in a high-growth zone (Healthcare/Finance) and secure the offer. Benefit: Locking in today’s price. |

| Month 2 | Purchase Completion & Visa Application | Finalize the purchase, transfer ownership, and submit the necessary documents for the UAE Golden Visa. Benefit: Securing long-term residency under the current, lower threshold. |

| Month 3 | Handover & Rental Activation | Receive the keys and immediately begin the leasing process. Benefit: Immediate cash flow generation and maximizing high rental yields (6.5% – 7%+). |

This swift roadmap is designed to bypass hesitation, ensuring you act decisively within the critical window of opportunity.

6. Final Call to Action: Don’t Let the Boom Pass You By

The economic indicators—the 4.4% GDP growth, the imbalance of demand over supply, and the looming Golden Visa threshold adjustment—are aligned in a once-in-a-cycle fashion. This is not a moment for passive observation; it is a critical juncture demanding rapid, informed action.

Dubai’s economic boom will not wait for slow movers.

Properties priced under the crucial AED 2 Million investment mark are the most sought-after assets and are being acquired daily. Every day you delay is a day you risk:

- Paying more for the same property (AED 300,000+ loss).

- Missing the current, lower Golden Visa entry requirement (AED 500,000+ loss).

Secure your future wealth and long-term residency now.

Click here to book your immediate consultation and let our specialists show you the last remaining Golden Visa opportunities before these prices become history.