Practical Investor Decision Post

The pursuit of superior asset performance and tax efficiency has driven countless British investors to diversify their portfolios internationally. As the UK market contends with fluctuating interest rates and steep capital gains taxes, the Dubai Off-Plan for UK Investors market stands out as a compelling, high-yield alternative for 2026 and beyond. This comprehensive guide is designed to transform interest into informed action, providing a practical roadmap covering financial advantages, regulatory safeguards, risk management, and key developer insights specifically tailored for the sophisticated British property investor.

1. The Key Differentiator: Flexible Off-Plan Payment Plans Dubai

The single most potent factor attracting global capital, especially from the UK, to Dubai’s off-plan sector is the ingenious structure of its developer payment plans. These plans fundamentally de-risk and streamline the investment process compared to traditional financing models often mandated in the UK.

1.1. Capital Efficiency: Mastering the Staggered Approach

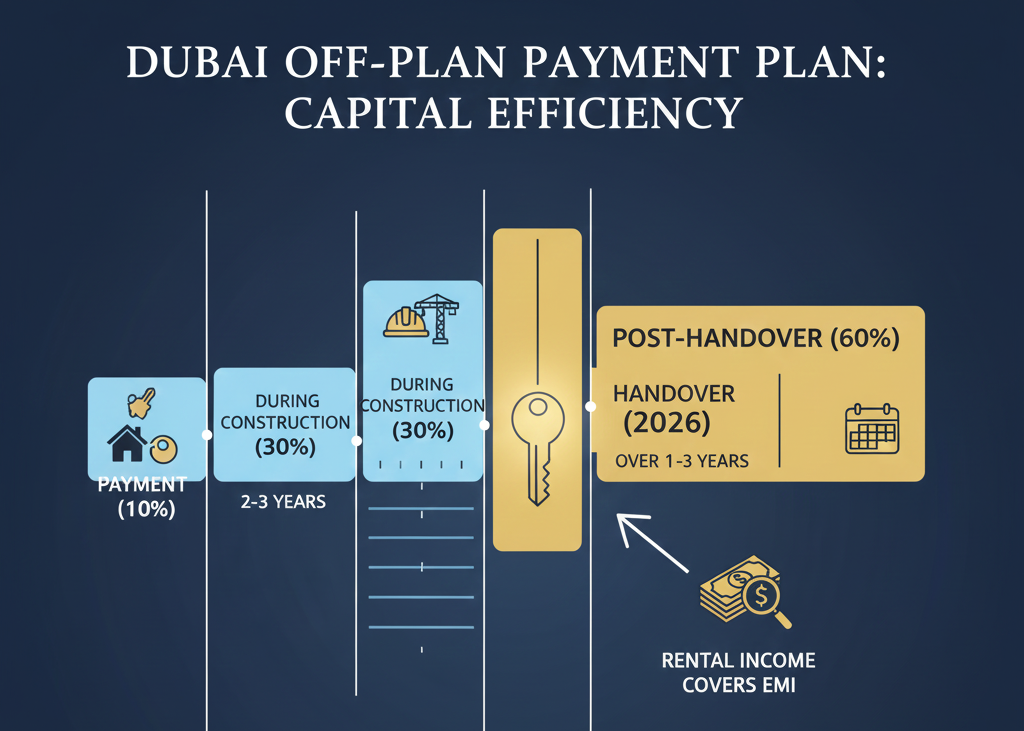

Unlike the UK model, which typically demands a substantial deposit and requires financing approval well before completion, Dubai’s off-plan terms allow for staggered capital deployment.

- Standard Off-Plan Model: A typical structure might be a 40/60 plan. This requires only 40% of the property value to be paid during the construction phase (which can span 2-3 years), with the remaining 60% due upon official handover in 2026.

- Post-Handover Payments: The most attractive variation is the Post-Handover Payment Plan (e.g., 50/50 over 2 years post-completion). This allows the investor to secure the asset, and then use the rental income generated after the property is operational to cover the final instalments. This creates a self-financing mechanism rarely seen in mature Western markets.

1.2. De-Risking the Development Timeline

By delaying the majority of the financial commitment until completion, investors protect their capital from potential construction delays or unforeseen market shifts during the build cycle.

Analysis for British Investors: The low initial outlay provides immediate capital preservation. Your funds remain liquid and accessible for longer, maximizing capital efficiency and reducing the opportunity cost associated with traditional property acquisition. The flexibility of Off-plan payment plans Dubai is a significant competitive edge.

2. Balanced Analysis: Risks vs. Rewards in the 2026 Market

A prudent investment decision requires a clear-eyed assessment of the upside potential balanced against manageable risks. Dubai’s real estate ecosystem is structured to maximise rewards while legislating against common off-plan risks.

2.1. The Substantial Rewards: Focus on Tax and ROI

Dubai continues to deliver robust returns driven by economic stability, government initiatives, and attractive tax policy.

- Exceptional ROI: The ROI Dubai property 2026 forecast remains highly positive, with significant capital appreciation expected in emerging sectors.

- Zero Tax Advantage: Investors benefit hugely from Dubai property investment tax benefits for British nationals, including Zero Income Tax on rental revenue and Zero Capital Gains Tax on property sale profits.

Comparative Financial Advantages for Dubai Off-Plan for UK Investors

| Reward Metric | Dubai Advantage | Supporting Data (To be inserted) |

| Capital Appreciation | Exceptional growth in prime and emerging areas driven by high demand and limited supply in niche sectors. | Insert: Projected Q3 2026 price growth rate (e.g., 10-15% Y-o-Y in key zones). |

| Rental Yield (ROI) | Average gross yields significantly outpace London and major European cities, where yields often struggle to exceed 4%. | Insert: Average Gross Yield in Dubai for apartments (e.g., 6.5% – 8%). |

| Tax Efficiency | Direct cost savings against the UK’s 20-28% Capital Gains Tax rate. | Contrast: Zero Income Tax and Capital Gains Tax in the UAE. |

2.2. Mitigating Off-Plan Risks: Delivery Timelines and DLD Security

The primary concern for off-plan buyers is the risk of developer failure or project delay. Dubai’s regulations, overseen by the Dubai Land Department (DLD), have fundamentally addressed this through stringent protective mechanisms.

- The Escrow Account Safeguard: All funds paid by investors for off-plan units must be deposited into a strictly regulated Escrow Account. This mechanism is known as DLD Escrow account security. Developers only receive staged payments from this account upon verified completion of predetermined construction milestones. This ensures that investor funds are protected.

- Managing Delivery Timelines: The DLD imposes penalties and has clear dispute resolution mechanisms. Furthermore, the DLD’s regulatory oversight ensures developers must demonstrate strong financial footing before launching a project, thereby reducing the risk of outright project abandonment.

Our Expert Take: For UK investors familiar with the legal intricacies of conveyancing, the DLD framework offers a remarkable level of transparency and security, making the off-plan process arguably safer than many perceive.

3. The Operational Blueprint: Legal Steps and Delivery Protocol

The successful execution of an off-plan purchase requires a clear understanding of the legal and administrative steps.

3.1. The Crucial Legal Steps for a Seamless Transfer

- Selection and Reservation: Once a unit is selected, the investor signs the Reservation Agreement (MOU) and pays a booking fee (typically 5-10%).

- Oqood Registration: Within a month, the developer registers the purchase contract with the DLD under the Oqood system. This registration is critical—it officially documents the investor’s legal claim to the property.

- Staged Payments: Payments are made according to the agreed-upon schedule (often linked to construction progress verified by the DLD).

- Final Transfer: Upon completion and full payment, the DLD issues the Title Deed in the investor’s name.

3.2. Navigating Delivery Timelines (2026 Focus)

As we look toward 2026, many projects launched in the 2023-2024 boom are scheduled for handover.

- Typical Timeline: Most medium-to-large-scale projects are completed within 24 to 36 months from the launch date.

- The Snagging Process: Before the final handover, the investor (or a representative, such as your personal consultant, James Sahota) conducts a thorough inspection, known as ‘snagging,’ to ensure all construction and finishing details meet the contractual standards. Only after satisfactory resolution of minor defects is the final payment and title transfer executed.

4. Developer Vetting: Popular Developers with London Offices

For British investors, the availability of a dedicated point of contact, preferably in a similar timezone or with an established UK presence, significantly enhances confidence and ease of transaction. This bridge ensures communication is smooth and documentation is familiar.

4.1. The Strategic Advantage of Local UK Presence

Developers with offices or strong representative teams in London or other major UK cities often provide:

- Familiar Regulatory Understanding: Teams versed in the nuances of international transactions and UK capital outflow.

- Accessibility: Consultations without the need for immediate travel to Dubai.

4.2. Recommended Developers with UK Footprints

Savvy Dubai Off-Plan for UK Investors should prioritize developers known for timely delivery, quality finishing, and transparency. This search for the Best Dubai developers with London offices is a key step in due diligence, ensuring reliable communication and familiarity with international standards.

Here are three leading developers with an established presence or significant operational links within the UK, offering robust investment security:

1. Emaar Properties: The Master Developer of Record

Emaar is arguably the most recognized real estate brand globally, responsible for landmark projects like the Burj Khalifa and Downtown Dubai.

- UK Footprint: Emaar maintains a significant international sales and investor relations presence, often facilitated through high-profile real estate firms in London, ensuring ease of communication and access to legal documentation suitable for British investors.

- Specialization: Known for large-scale, high-end, master-planned communities (e.g., Dubai Hills Estate, Emaar Beachfront). Their established track record and financial stability significantly mitigate project completion risk, which is paramount for off-plan purchases.

- Investor Advantage: Investing with Emaar provides the highest level of brand confidence and is often linked to the fastest appreciation rates in master-planned communities, aligning perfectly with the ROI Dubai property 2026 forecast.

2. DAMAC Properties: Luxury and Competitive Off-Plan Terms

DAMAC has aggressively targeted the UK market and is well-known across major UK cities for its luxury and high-profile developments, including collaborations with prestigious global fashion houses.

- UK Footprint: DAMAC has a visible presence in the UK, frequently advertising and maintaining direct contact points, which simplifies the initial consultation and negotiation process for British buyers.

- Specialization: Often focuses on high-end, luxury residential units and branded residences, providing exceptional amenities. They frequently offer some of the most competitive and flexible Off-plan payment plans Dubai, including attractive post-handover structures that appeal directly to international investors managing currency exchange and capital outflow.

- Investor Advantage: The focus on luxury segments targets high-net-worth individuals and promises premium rental yields, maximizing the Dubai property investment tax benefits for British nationals due to higher income potential.

3. Nakheel: Strategic Infrastructure and Location Security

Nakheel is the developer behind some of Dubai’s most strategic and recognizable projects, including Palm Jumeirah and The World Islands.

- UK Footprint: While sometimes operating through partnerships, Nakheel’s global profile and the strategic importance of its projects ensure they are widely represented by major London-based international property consultants, guaranteeing expert local access.

- Specialization: Specializing in key infrastructure projects and unique geographical developments, offering stable, long-term investment opportunities in strategically important, high-demand locations.

- Investor Advantage: Investment in Nakheel projects often offers a strong hedge against market volatility due to the uniqueness and scarcity of the locations they develop, providing solid asset security protected by the regulatory environment secured by DLD Escrow account security.

Actionable Insight: We recommend arranging an introductory call with the UK office or a UK-based representative of the chosen developer. This should be followed by a formal due diligence review facilitated and overseen by James Sahota’s expert advisory service. Engaging with James Sahota ensures your transaction is meticulously optimized for international legal compliance and superior financial efficiency.

Conclusion: Securing Your Position in the 2026 Dubai Market

The opportunity presented by Dubai’s off-plan market in 2026 is uniquely timed. Favourable government policies, the attractive Dubai property investment tax benefits for British nationals, and the robust legal safety net provided by the DLD make this market structurally sound. For the British investor, the flexible payment plans provide an unparalleled mechanism for capital efficiency and risk management.

Ultimately, the best investments in the Dubai Off-Plan for UK Investors segment are those secured with expert local knowledge. Moving from decision to execution requires specialist guidance. [here] we specialise in bridging the gap for international investors, offering bespoke market analysis, legal facilitation, and direct liaisons with leading developers.

Next Step: Unlock Your Tailored Strategy

Are you ready to map your capital into the most profitable Dubai Off-Plan projects scheduled for 2026 completion? Contact James Sahota directly [here] today for a confidential, free consultation tailored precisely to your specific financial objectives and UK investor profile.