Introduction: Why the Herd Mentality Fails in Dubai

Dubai real estate continues its remarkable surge, with the market index projected to climb from approximately 206 (Nov 2024) to 234 by the end of 2025. However, this “rising tide” is deceptive. The market is maturing, and indiscriminate Dubai Property Investment 2025 is no longer a viable strategy.

To secure outsized returns in 2025, investors must move beyond generic headlines and analyze where true value is being created—and, crucially, where it is being lost. We analyzed granular transaction, sales, and rental data to identify the actual winners, expose the overhyped areas, and provide the contrarian framework you need for strategic investment.

1. The Capital Growth Paradox: Established Communities Beat the Hype

A key insight from the 2024-2025 data is that investor focus on high-volume, newly launched “hype” areas came at the expense of capital appreciation.

Winners: The Unsung Champions of Appreciation

The biggest gains were found in mature, established, and often undervalued apartment communities:

- Motor City: Delivered a staggering 32.81% appreciation.

- Living Legends: Close behind with 30.04% growth.

- Al Furjan: Posted significant gains at 28.72% growth.

These communities, often offering larger layouts and established amenities, proved to be far more desirable to end-users and investors seeking actual capital uplift than many high-rise off-plan projects.

Losers (The Liquidity Trap): The Business Bay Paradox

The classic contrarian insight emerges when we compare growth to volume:

- High Volume ≠ High Appreciation: Business Bay saw a massive number of transactions (136 deals), signaling high liquidity. Yet, its appreciation rate was only 4.08%.

- The Depth of the Problem: Compare this to Dubai Investment Park (DIP), which had significantly fewer transactions but posted a high appreciation of 21.23%. This demonstrates that while Business Bay offers ease of exit, its price growth is constrained by heavy supply, pushing smart capital toward zones with controlled inventory.

2. Myth-Busting: The 1-Bedroom Liquidity Trap and Unit Scarcity

The market analysis based on bedroom numbers reveals a significant mismatch between investor focus and end-user demand.

The Demand Divergence

| Category | 1 Bed | 2 Bed | 3 Bed | Investor Insight |

| Listings (Supply) | 33.2% (Highest Supply) | 24.3% | 12.2% | Oversupply risk is highest in 1-Beds, creating intense competition. |

| Views & Leads (Demand) | 15.8% | 17.2% | 17.4% | The highest real interest/demand is for larger units (2- and 3-Bed). |

| Transactions (Liquidity) | 23.0% | 20.1% | 7.7% | 1-Bed units are the easiest to sell, driven by lower entry price (Avg. AED 1.47M). |

What Investors Need to Know for Successful Dubai Property Investment 2025

The high transaction volume in 1-Bed units is a result of low barrier to entry, but the oversupply visible in the listings percentage (33.2%) and lower demand signal (15.8% views) suggests future price growth will be constrained.

- Recommendation: Smart investors should allocate capital to 2-Bed units (Avg. AED 2.67M). They offer high liquidity and meet the concentrated area of end-user demand, suggesting better capital growth potential as the city matures.

3. The Rental Market Reality: The Cost of Oversupply

The rental price distribution data confirms that the market is heavily skewed towards affordability, placing intense pressure on mid-to-high-end properties when supply increases.

The Price Concentration

Over half of the rental market volume (11,495 units) falls into the under AED 80,000 per year category. This explains why stability and controlled supply are critical for yield protection.

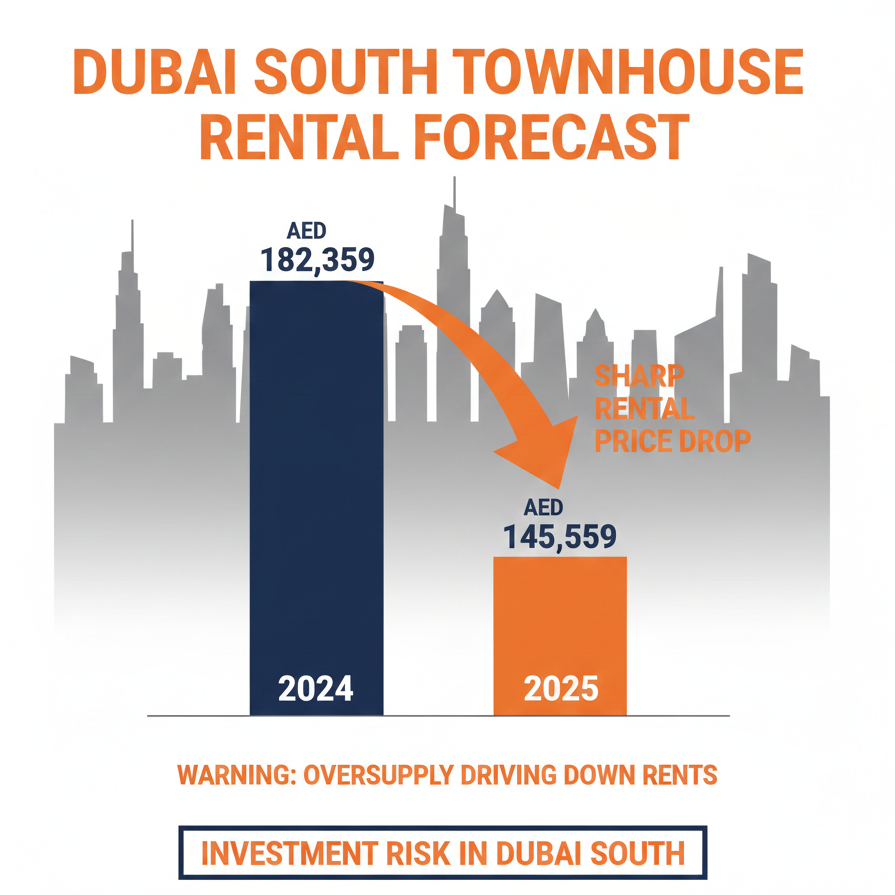

Losers: The Dubai South Rental Shock

This concentration explains the dramatic underperformance in certain villa rental markets:

- Dubai South Townhouses saw their average rental price plummet from AED 182,359 (2024) to AED 145,559 (2025).

- The Yield Erosion: These units fell out of the premium bracket (AED 160K–200K) and into the highly competitive mid-range (AED 120K–160K), where tenant choice is wider.

- The Lesson: Investing in areas with massive unit pipelines (like Dubai South) without existing infrastructure and tenant pools poses a high risk to rental income stability.

Winners: Strong Rental Growth in Established Spots

Strong rental growth was seen where tenant demand for quality housing outpaced moderate supply:

- Motor City Apartments: Rentals surged from AED 90,895 (2024) to AED 279,972 (2025). While this extreme jump may indicate shifting unit mix, it highlights robust demand for quality in mature suburbs.

- Dubai Water Canal Apartments: Saw an impressive increase from AED 177K to AED 230K.

4. Villa Performance: Capitalizing on Scarcity and Size

The demand for high-end, established villa communities continues to drive significant capital appreciation, validating the shift toward green, mature family living.

Villa Growth Champions

- Victory Heights: The clear leader in the villa market, achieving 41.90% appreciation.

- The Meadows: Showed strength with 32.49% growth.

Crucially, the average sale price data confirms the value placed on size: A 5-Bed unit averages AED 16.1 million, while a 7-Bed unit averages over AED 44.4 million. Investors who secured scarce, large plots in premium, finished communities saw massive gains.

5. Developer Strategy and Long-Term Market Maturity

The market is currently near an all-time high, with the index predicted to reach 234.73 by August 2025. This upward trend, driven by sustained global interest, suggests caution rather than aggressive speculation.

Developer Dominance

Understanding the market share is vital for evaluating project stability and future sales liquidity:

| Developer | Market Share (Units) | Strategic Focus |

| Emaar | 23,305 | Dominant in Prime and Ultra-Luxury (e.g., Downtown, Palm Jumeirah). Offers perceived stability and brand premium. |

| DAMAC Properties | 21,357 | Strong presence, often focusing on high-volume, themed luxury developments. |

| Binghatti | 15,577 | The rapid challenger, focused on high-volume mid-to-high-end projects with competitive prices. Appeals to capital-efficient investors due to quick execution. |

Strategic Summary: What Investors Need to Know for Dubai Property Investment 2025

Based on all the data analyzed, 2025 is defined by three key strategic imperatives:

- Prioritize Yield Protection Over Hype: High capital growth in areas like Motor City (32%+) shows that focusing on proven infrastructure and end-user satisfaction yields better returns than chasing high transaction volumes in saturated spots (like Business Bay).

- Move Up the Bedroom Ladder: Due to clear oversupply in the 1-Bed category (33% listings) and overwhelming demand for 2- and 3-Bed units, investment dollars should target larger units to capitalize on future scarcity and demand.

- Hedge Against Supply Shocks: The steep rental decline in Dubai South Townhouses is a warning. Investors must be aware of the delivery pipeline for similar unit types in their specific area to mitigate the risk of falling into highly competitive, low-yield rental brackets.

Conclusion: Securing Your Winning Portfolio

The Dubai Property Investment 2025 market is not a lottery; it is a surgical environment. The data clearly shows a major shift: stop chasing volume and start chasing value/scarcity.

Are you equipped to navigate the data-driven market of 2025?

Ready to strategic Dubai Property Investment 2025?

Contact our expert team today for a tailored investment analysis based on current transaction data, not market myths.