The Dubai real estate market is no longer a speculative playground; it has evolved into a sophisticated global hub for institutional and private wealth. As we look toward the next horizon, Dubai Rental Yield Strategies 2026 have become the primary focus for savvy investors. For landlords in the United Kingdom and India—who consistently rank among the top buyers in the emirate—the upcoming 24 months represent a critical window to reposition their portfolios for maximum income.

With the Dubai Economic Agenda (D33) aiming to double the city’s economy by 2033, the rental market is under immense pressure. This guide provides a deep dive into the most effective Dubai Rental Yield Strategies 2026, focusing on high-growth areas like Business Bay, JVC, and Dubai Marina.

1. The 2026 Outlook: Why Strategy Trumps Luck

In previous cycles, simply “owning property” in Dubai was enough to see gains. However, as the market matures, the delta between a 5% yield and a 9% yield lies in professional management and strategic timing.

For UK investors, the motivation is clear: escaping the UK’s tightening tax net and low-yield Buy-to-Let market. In Dubai, the 0% tax on rental income remains a powerful magnet. For Indian landlords, Dubai offers a currency hedge and a stable second home just a short flight away. But to win in 2026, you need more than just a title deed; you need actionable Dubai Rental Yield Strategies 2026.

2. Targeted Area Analysis: The Yield Engines

To maximize ROI, you must look where the city is growing. Infrastructure is the biggest driver of rental premiums.

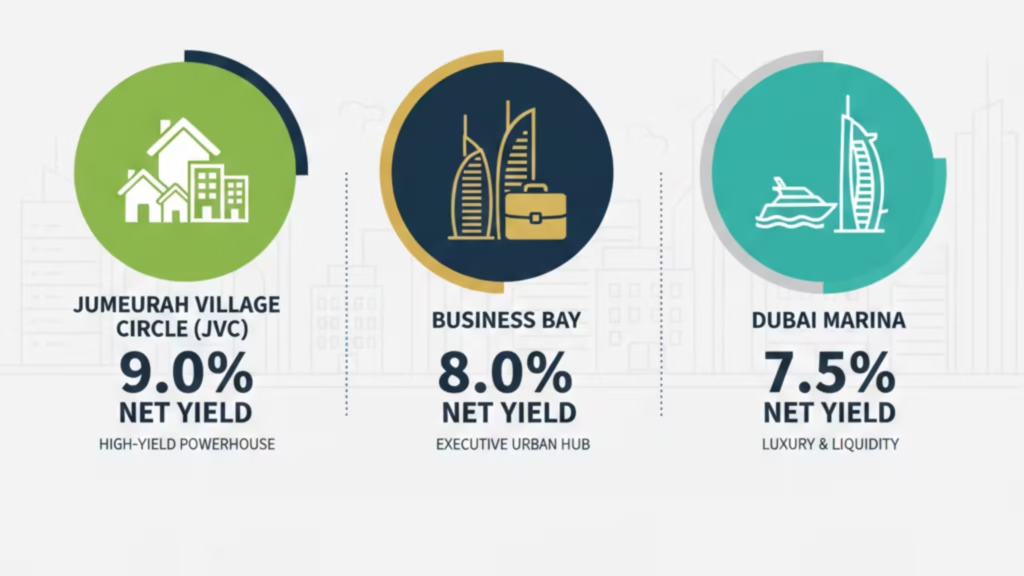

Jumeirah Village Circle (JVC): The High-Yield Powerhouse

JVC is currently the “sweet spot” for rental income. It offers a combination of affordable entry points and high tenant demand.

- The 2026 Forecast: As central Dubai reaches saturation, mid-market professionals are flocking to JVC.

- The Strategy: Focus on studios and 1-bedroom apartments. The “Net Yield” here is often 2-3% higher than in luxury waterfront districts because of lower service charges and higher occupancy rates. This is a core pillar of successful Dubai Rental Yield Strategies 2026.

Business Bay: The Executive Hub

Business Bay has transformed from a construction site into a vibrant residential and commercial canal-side destination.

- The 2026 Forecast: With major global firms moving their headquarters to Dubai, the demand for executive housing is skyrocketing.

- The Strategy: Invest in “Branded Residences.” High-net-worth tenants in 2026 will pay a premium for lifestyle amenities, concierge services, and proximity to the DIFC.

Dubai Marina: The Resilience of a Global Icon

Dubai Marina remains the most searched location for rentals. While capital appreciation has been high, landlords must be creative to keep yields above 7%.

- The Strategy: Shift to the “Short-Term Rental” model. Data suggests that holiday homes in the Marina outperform long-term leases by 20-35% during the winter months.

3. Implementing Dubai Rental Yield Strategies 2026

To truly outperform the market, you need to implement these three advanced tactics:

I. The “Renovate to Elevate” Tactic

Much of the secondary market stock in Dubai is now 10-15 years old. A significant part of Dubai Rental Yield Strategies 2026 involves modernizing these assets. By spending 5-10% of the property value on modern flooring, open-plan kitchens, and smart home lighting, landlords can increase their rental asking price by up to 25%.

II. Short-Term vs. Long-Term Optimization

The flexibility of the Dubai market allows you to switch. For 2026, we recommend a “Hybrid Model.” Renting your property on a short-term basis during the peak tourist season (October to March) and securing a premium mid-term tenant for the remainder can push your annual net yield into the double digits.

III. Strategic Refinancing for Portfolio Growth

For UK and Indian landlords with existing equity, 2026 will be an ideal time to look at equity release. Leveraging one performing asset to finance a high-yield unit in an emerging area like JVC is a classic move in the Dubai Rental Yield Strategies 2026 playbook.

For UK and Indian landlords with existing equity, 2026 will be an ideal time to look at equity release. Leveraging one performing asset to finance a high-yield unit in an emerging area like JVC is a classic move in the Dubai Rental Yield Strategies 2026 playbook.

Whether it is through high-end furnishing or converting to short-term rentals, the goal is to outpace the market average. To execute these tactics effectively, seeking expert property management is essential.

4. Case Study: From 6% to 9.5% in 18 Months

Consider a landlord from Mumbai who owned a standard unit in Downtown Dubai. By mid-2024, the yield had stagnated at 6% due to rising service charges. Following a consultation focused on Dubai Rental Yield Strategies 2026, the landlord:

- Sold the Downtown unit at a capital gain.

- Reinvested into two units in JVC.

- Applied a professional interior design package. The result? A diversified portfolio yielding a net 9.5% with higher liquidity and lower maintenance overheads.

5. Regulatory Mastery: RERA and the Rental Index

Understanding the RERA (Real Estate Regulatory Agency) laws is vital. In 2026, the Rental Index will be even more data-driven. Landlords must know when they are legally allowed to increase rent and how to use the “Rental Valuation Certificate” to bypass the standard index caps if their property is significantly upgraded. This legal awareness is a non-negotiable part of your Dubai Rental Yield Strategies 2026.

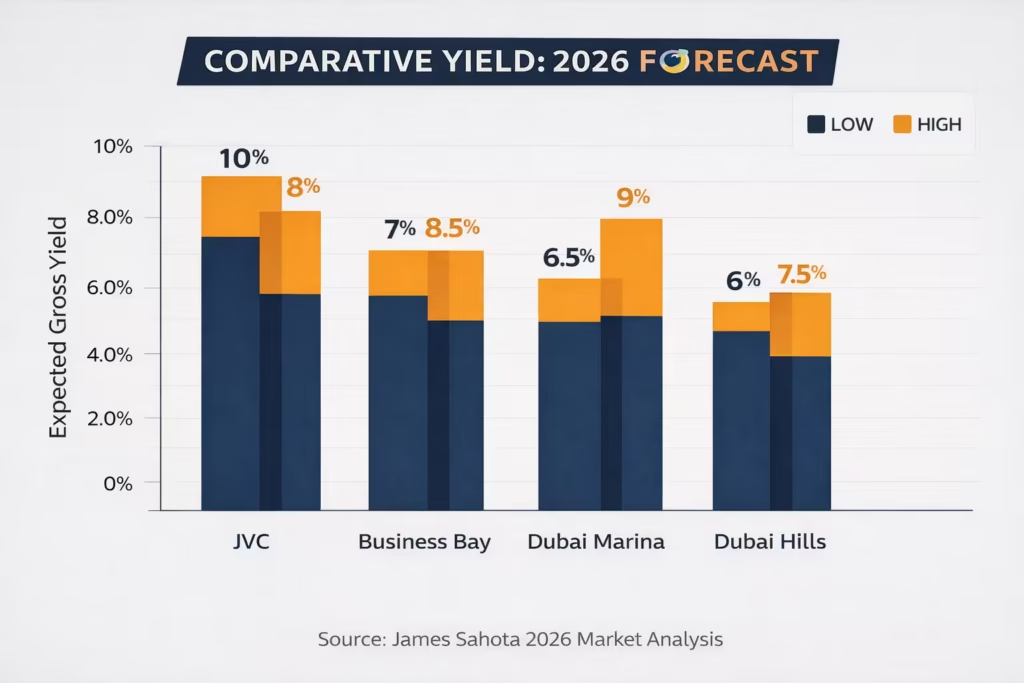

6. Comparative Yield Table: 2026 Forecast

| District | Expected Gross Yield | Primary Tenant Profile | Strategy Recommendation |

| JVC | 8.5% – 10% | Mid-level Professionals | Long-term Unfurnished |

| Business Bay | 7% – 8.5% | Tech & Finance Execs | Short-term / Corporate Lease |

| Dubai Marina | 6.5% – 9% | Tourists & Expats | Holiday Home Model |

| Dubai Hills | 6% – 7.5% | Families (High Income) | Long-term / 2-year Leases |

7. FAQ: Mastering Dubai Rental Yield Strategies 2026

Q: What is the biggest risk to rental yields in 2026? A: Over-supply in certain sub-communities. This is why your Dubai Rental Yield Strategies 2026 must prioritize “established” or “infrastructure-linked” areas like JVC and Business Bay over speculative desert projects.

Q: How often should I review my rental strategy? A: We recommend a portfolio audit every 6 months. The Dubai market moves fast, and what worked in 2024 might need adjustment by 2026.

Q: Can I manage these strategies from the UK or India? A: While possible, it is highly inefficient. Professional property management is the “secret sauce” that ensures your yields remain high by minimizing vacancy periods and handling tenant relations.

Conclusion: Future-Proofing Your Investment

The 2026 rental boom in Dubai is a massive opportunity, but it requires a shift from a “passive landlord” to an “active investor” mindset. By focusing on the right areas, leveraging the short-term market, and utilizing professional management, UK and Indian landlords can achieve unprecedented returns.

Your success depends on the data you use and the team you have on the ground. Dubai Rental Yield Strategies 2026 are not just about numbers; they are about securing your financial future in the world’s most dynamic real estate market.

Ready to Optimize Your Portfolio?

Don’t leave your returns to chance. Whether you are looking to enter the market or want to audit your existing Dubai assets for 2026, James Sahota provides the expert, boots-on-the-ground insights you need.

[Book a Private Consultation with James Sahota Today]