The Hook & The Stealth Tax

The £24,000 Shock: If you earn £60K, Budget 2025 just added £24,000 to your 10-year tax bill

“For years, high-net-worth individuals (HNWIs) and high earners in the UK have navigated rising living costs and political instability. The UK Budget 2025, however, marks a significant turning point, and our exclusive UK Budget 2025 tax calculator reveals a financial burden that is both substantial and deceptively quiet.”

The primary culprit is Fiscal Drag. This isn’t a headline-grabbing tax increase; it’s worse. It occurs when inflation and rising wages push people into higher tax brackets, while the personal allowances and tax thresholds remain frozen. Because the government has decided to freeze the income tax and National Insurance thresholds until 2031, every pay rise and inflationary adjustment will simply result in a larger slice of your income being taken by the Exchequer. It’s a stealth tax on aspiration, punishing those who earn more for working harder.

For someone earning £60,000 today, this slow, persistent erosion of wealth equates to an estimated £24,000 loss over the next decade. This is the hidden cost of staying put.

Stop guessing. The financial decisions you make today—or the lack thereof—will define your net worth for the next generation. It’s time to confront the true cost of the UK tax increase calculator reality.

Use our exclusive calculator below to see YOUR exact financial impact and understand the true cost of staying put.

Interactive Calculator

Calculate Your True Cost: The UK Budget 2025 Tax Increase Calculator

Understanding the precise impact of the Budget’s frozen thresholds and new duties is the first step toward reclaiming your financial autonomy. Our interactive UK Budget 2025 tax calculator is designed to quantify your exposure across wages, savings, and investments.

Simply input your current salary, pension contributions, and any dividend or rental income. The tool provides a personalized projection, illustrating the financial pain points in clear, quantifiable terms.

| Input Fields | Output (The Pain) |

| Current Salary (£) | Annual Extra Tax Paid (£) |

| Savings/Dividends (£) | 10-Year Projection (£) |

| Pension Contributions (£) | Lifetime Impact (Color-Coded) |

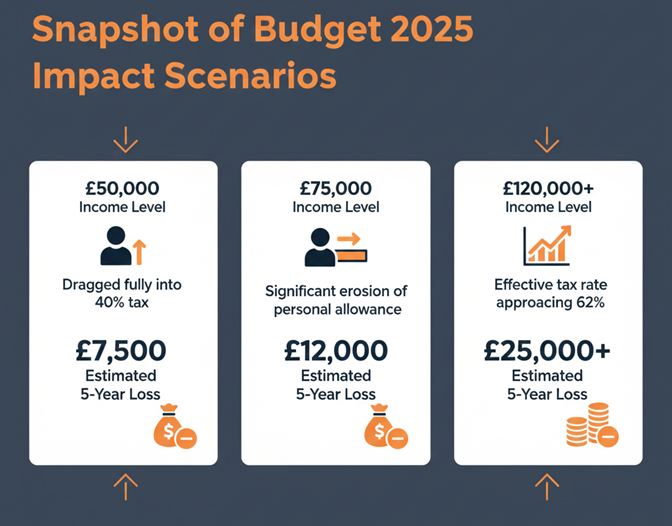

Snapshot of Budget 2025 Impact Scenarios:

| Income Level | Primary Effect | Estimated 5-Year Loss |

| £50,000 | Dragged fully into the 40% tax band | £7,500 |

| £75,000 | Significant erosion of personal allowance | £12,000 |

| £120,000+ | Effective tax rate approaching 62% | £25,000+ |

Budget 2025 Tax Changes: What Changed and Who Pays

Deciphering the Freeze: Key Tax Changes in Budget 2025

The 2025 Budget is a complex mix of freezes, hikes, and new duties, all strategically designed to increase government revenue, primarily targeting wealth and high earnings.

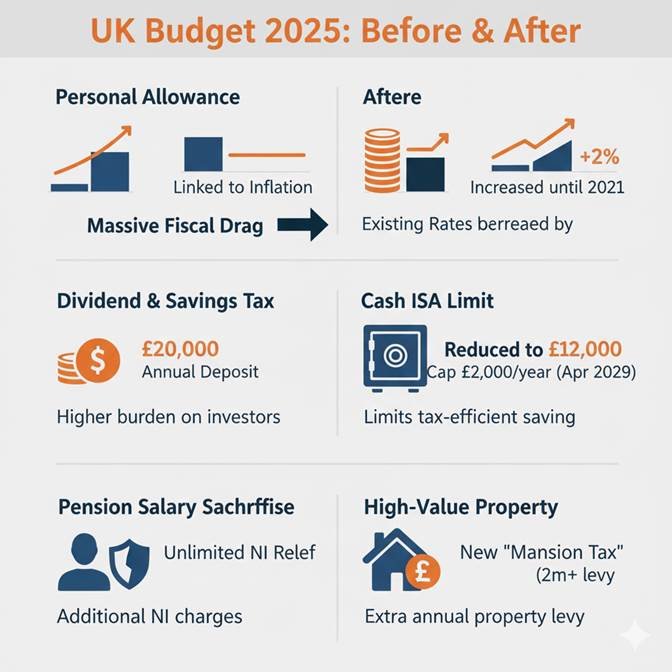

| Feature | Pre-Budget Status | Post-Budget 2025 Changes | Impact Summary |

| Personal Allowance (Threshold) | Linked to Inflation | Frozen until 2031 | Massive Fiscal Drag. Pushes millions into higher tax bands. |

| Dividend & Savings Tax | Existing Rates | Increased by +2 Percentage Points | Significantly higher burden on investors and company directors. |

| Cash ISA Limit | £20,000 Annual Deposit | Reduced to £12,000 | Discourages tax-efficient cash saving, limiting protection. |

| Pension Salary Sacrifice | Unlimited NI Relief | Cap at £2,000 per year (Effective April 2029( | Additional NI charges on contributions above the cap. Planning must start now. |

| High-Value Property Tax | Standard Council Tax | New “Mansion Tax” Introduced | Extra annual levy on properties valued over £2 million. |

The Target Audience: Who Gets Hit Hardest?

While the tax drag affects everyone, several groups are disproportionately targeted:

- The £50k-£75k Earners: These individuals, who perceive themselves as middle-class, will suddenly find themselves fully exposed to the 40% higher rate as their personal allowances are eroded and their threshold remains fixed.

- The £100k+ Earners: The combination of the frozen tax band and the accelerated withdrawal of the Personal Allowance between £100,000 and £125,140 means their effective marginal tax rate can quickly soar to 62%.

- Property Owners: The introduction of the Mansion Tax means owning high-value residential properties (e.g., a £2.5m home incurs a £2,500 annual levy) now comes with an added, recurring penalty, directly squeezing long-term returns.

- Example: Sarah, a marketing manager earning £65,000, will pay an additional £1,800 in tax next year alone due to the fiscal drag, severely limiting her ability to save for a deposit.

The Exodus Data: Trust is Broken

Tax Exodus: UK Wealth Migration After Budget 2025

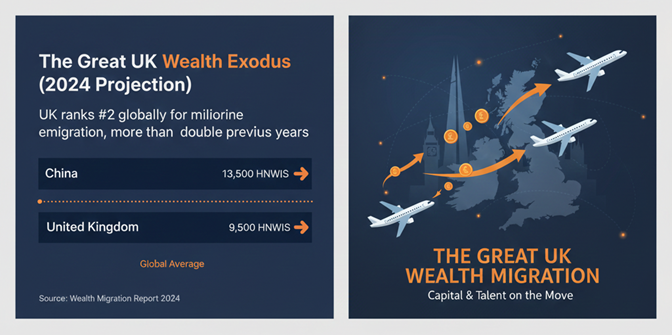

The Budget’s actions are not happening in a vacuum; they reflect a growing hostility towards private wealth that is driving a historical movement of capital and talent.

Data from wealth migration specialists confirms that the UK is suffering an unprecedented exodus. In 2024, the UK is projected to lose approximately 9,500 to 10,800 millionaires (HNWIs)—the second-highest number globally, second only to China. This is more than double the number seen in previous years.

This trend is not merely tax avoidance; it is a profound loss of faith in the UK’s financial stability and its willingness to reward entrepreneurship and investment. HNWIs are not simply looking for cheaper tax jurisdictions; they are seeking tax certainty and a government that views them as assets, not liabilities.

The most popular destinations for this departing wealth are not random; they are jurisdictions offering clear, long-term financial sovereignty. Unsurprisingly, the UAE tops the list of global destinations attracting this mobile wealth.

The Strategic Pivot (Bridge Paragraph)

Is There a Financial Safe Haven?

In light of the ongoing tax squeeze, the Mansion Tax, and the systematic reduction in tax-efficient investment vehicles like ISAs, high-net-worth individuals are not simply looking for tax relief; they are seeking tax sovereignty. They are pivoting their residency and capital to jurisdictions that actively reward wealth preservation and capital growth, rather than penalizing them. This seismic shift is why exploring global tax-efficient alternatives is no longer optional—it is a financial imperative.

5 Tax-Efficient Alternatives UK Citizens Are Exploring

For UK citizens whose wealth structures are fundamentally compromised by the 2025 Budget, exploring residency and wealth restructuring outside the UK offers the most definitive solution.

Alternative 1: UAE (Dubai/Abu Dhabi) – The Financial Safe Haven

The UAE has positioned itself as the definitive global antidote to high taxation and financial instability. For the UK investor, the benefits are clear, immediate, and comprehensive.

- The 0% Tax Reality: The core attraction is the complete absence of personal income tax, capital gains tax, and inheritance tax. This is not a temporary scheme; it is the foundation of the nation’s economic model.

- Investment Gateway & The Golden Visa: Investing AED 2 million (approx. £430k) in property immediately qualifies the investor for a 10-Year Golden Visa. This secures a stable, long-term residency status for the investor and their family, providing an essential “Plan B.”

- ROI Comparison: UK rental yields often hover around 3-4% (gross, before income tax and costs). Dubai property yields consistently deliver 7-9% net returns—completely tax-free—offering double the passive income compared to UK markets.

Case Study: James, a retired fund manager, faced a 40% inheritance tax liability on his estate and significant dividend tax hikes. Instead of buying a limited-yield, taxable buy-to-let in the UK, he redirected £500,000 into a prime Dubai property. The resulting 7.5% net yield provided him with £37,500 annual income, entirely tax-free and outside the scope of UK inheritance tax.

| Feature | UK (post-Budget 2025) | UAE (Dubai) | The Financial Impact |

| Income Tax | Up to 45% (High Earners) | 0% | Retain 100% of your earnings. |

| Capital Gains | Higher Rates, Reduced Allowances | 0% | Full profit realization upon sale. |

| Inheritance Tax | Up to 40% | 0% | Complete generational wealth protection. |

Alternative 2: Portugal (NHR 2.0 / New Regime)

Key Benefit: Offers a special tax status for new residents. While rules have tightened recently, it remains highly attractive for specific high-value professions and passive income sources.

- Residency: The Golden Visa program provides a route to residency through investment funds (real estate route is restricted but alternatives exist).

- Appeal: Strong choice for those who desire EU access and moderate taxation on local income.

Alternative 3: Italy (Flat Tax Regime)

- Key Benefit: High-net-worth individuals can opt for a €200,000 annual lump-sum tax on all foreign income (recently increased from €100k for new applicants).

- Appeal: Highly attractive for billionaires and UHNWIs who generate massive foreign income, as it caps their global tax liability effectively.

Alternative 4: Switzerland (Lump Sum Taxation)

- Key Benefit: Available for non-working, wealthy non-Swiss nationals. The annual tax is negotiated and based not on actual income, but on the applicant’s living expenses.

- Appeal: Offers exceptional privacy, political stability, and a bespoke tax arrangement, primarily targeting ultra-high-net-worth families.

Alternative 5: Singapore

- Key Benefit: Operates a territorial tax system, meaning foreign-sourced income is often not taxed unless remitted into Singapore. Low corporate tax rates make it a highly attractive hub for startups and corporate relocations.

- Appeal: Gateway to the Asian market combined with exceptional stability and a favourable business environment.

How to Get Started (Action Steps)

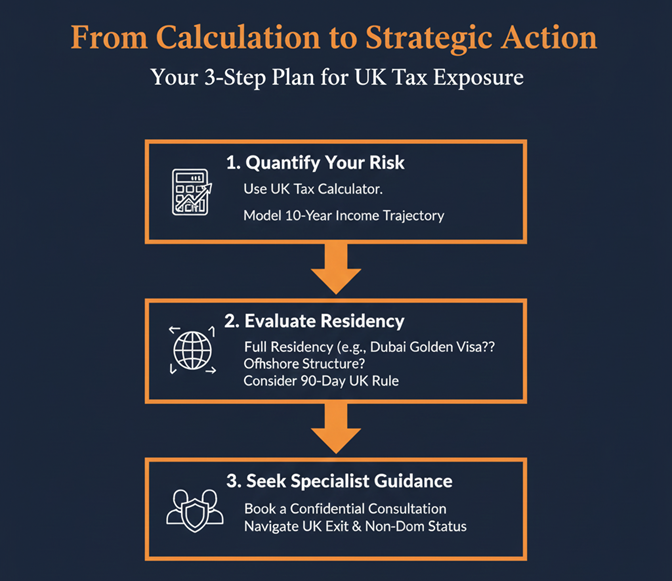

Your Next Step: From Calculation to Strategic Action

The implementation of the UK Budget 2025 signals a decisive shift: passive financial management is no longer viable for high earners and investors. Your wealth requires an active, cross-border strategy.

- Quantify Your Risk: Use the UK Budget 2025 tax calculator again, but this time, model your income trajectory for the next ten years to understand the total potential loss.

- Evaluate Residency: Determine if you need full residency (e.g., Dubai’s Golden Visa) or if an offshore structure is sufficient. This requires careful consideration of the 90-day UK residency rule.

- Seek Specialist Guidance: Tax migration is complex, involving UK exit rules, non-dom status changes, and establishing legal tax residency elsewhere. Mistakes can be extremely costly. Do not rely on generic advice.

This moment demands a strategic response. You’ve calculated your losses; now is the time to plan your escape and secure your financial future.

Don’t just calculate your losses. Plan your escape. Book a confidential, strategic consultation with our Dubai asset preservation experts today. We specialize in assessing UK tax exposure and facilitating the acquisition of high-yield, tax-efficient property investment in the UAE.