What if you invested £60,000 back in 1995? One buyer chose Manchester, the other Dubai Marina — a perfect case study of UK vs Dubai property investment ROI over 25 years.

UK Market Context (1990s–2025)

The 1990s and early 2000s

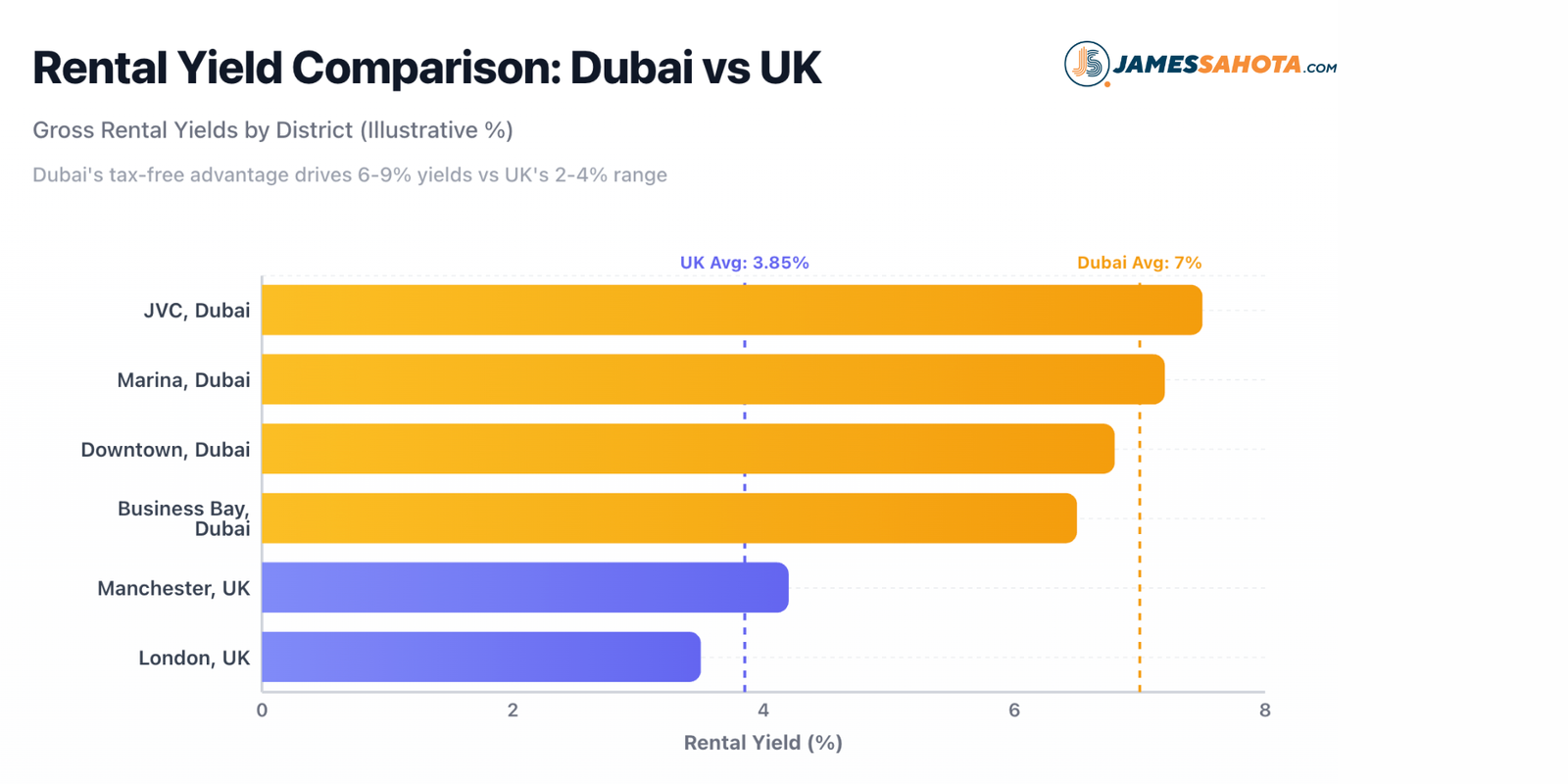

In 1995, a two-bed terrace in Manchester’s Ancoats district or Birmingham’s Jewellery Quarter averaged around £60,000 — a number that today feels almost surreal. Back then, UK property yields were modest (2–4 %), and mortgage rates hovered around 8–9 %. Buyers relied on gradual appreciation and long-term stability.

According to the Nationwide House Price Index, UK house prices in the mid-1990s were roughly one-third of today’s values. The HM Land Registry confirms that even through the dot-com boom and 2008 crisis, UK property values never suffered long-term decline — just slower growth cycles. (landregistry.data.gov.uk)

2000s to 2025 — London vs Regional Growth

Between 2000 and 2015, London’s Docklands exploded — apartments bought for £150,000 in 2000 often exceeded £600,000 by 2020. Regional cities like Manchester and Leeds followed, boosted by regeneration projects and HS2 planning.

As of September 2025, the Office for National Statistics (ONS) reports the average UK house price at £273,000, up 2.2 % year-on-year. (ONS October 2025 release)

That’s a 350 % nominal gain since 1995 — impressive on paper, but only ~120 % real growth when adjusted for inflation. Typical yields remain 3–4 % gross in Manchester and 2 % in central London.

Inflation-Adjusted ROI

Our 1995 investor who spent £60,000 might today see the property worth around £160,000. Over 30 years, this equals ~240 % total return (≈ 4–5 % per year). Add £45,000 in rental income (before taxes and maintenance) = £205,000 total return.

In real terms, this represents moderate growth — safe, predictable, but slow. UK property’s strength lies in stability, liquidity, and rule of law — not explosive ROI.

Dubai Market Context (2010–2025)

The 2010 Era — Birth of Modern Dubai Real Estate

In 2010, Dubai was recovering from the 2008 crash. Emaar Properties had just delivered Burj Khalifa and Downtown Dubai, while Nakheel restarted work on Palm Jumeirah and announced Palm Jebel Ali’s revival.

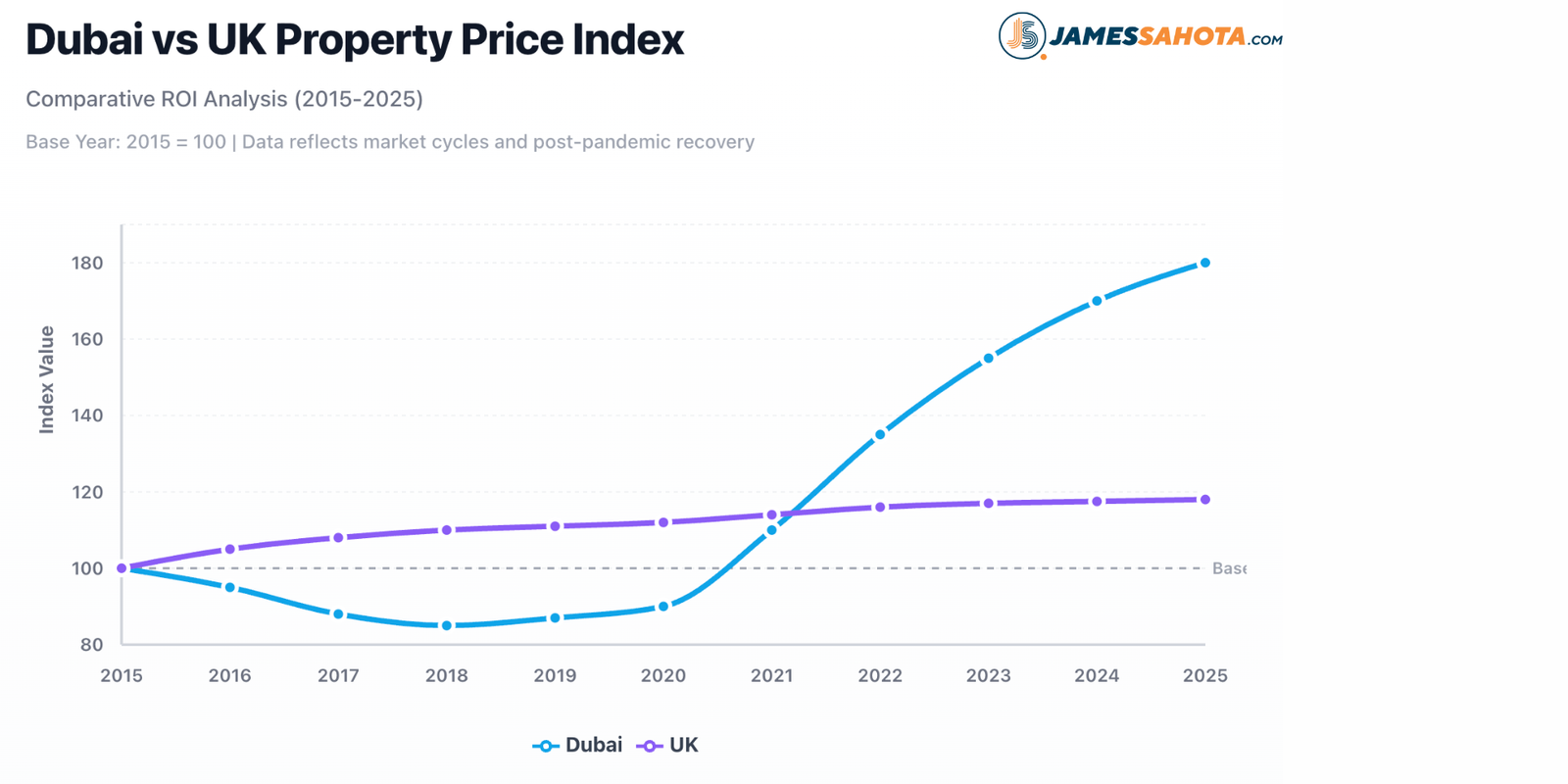

At that time, 2-bed apartments in Dubai Marina started around AED 1.2 million (≈ £200k). By 2025, similar units exceed AED 3.2 million (≈ £700k). That’s >150 % capital growth over 15 years — a remarkable figure by any global standard.

Early off-plan investors bought directly from developers such as Emaar, Nakheel and Damac with 10 % booking deposits and 3–5-year payment plans — an advantage absent in the UK. This Dubai off plan investment returns model became the foundation of many success stories.

2010–2025 Performance and Yields

According to the Dubai Land Department (DLD) Residential Price Index, Dubai property prices rose 7.8 % year-on-year by mid-2025. (dubailand.gov.ae RPPI)

Meanwhile, rental values climbed 14 % in Q1 2025, with average gross yields of 6–9 % across freehold communities. (cavendishmaxwell.com Q1 2025 report)

New communities like Emaar’s The Oasis (launched 2023) and Aldar’s Haven by Aldar offer modern payment plans and rental ROI averaging 8 %. Hudayriyat Island Abu Dhabi, Palm Jebel Ali, and Dubai South Expo Valley represent the next wave of high-potential developments.

ROI Simulation Table

| Market | Initial Investment | Rental Income Over Period* | Capital Growth Estimate | Total ROI % (approx) |

|---|---|---|---|---|

| UK (1995–2025) | £60,000 | ~£45,000–50,000 (gross) | £60k → ~£160,000 | ≈ 240 % over 25 yrs → ~4–5 % p.a. |

| Dubai (2010–2025) | £60,000 eq. | 7 % yield avg × 15 yrs ≈ £63,000† | 3–4× growth → £60k → £180–240k | ≈ 338 % over 15 yrs → ~8 % p.a. |

Why the Gap Exists

- Rental Yields: UK 2–4 % vs Dubai 6–9 %. Higher cashflow accelerates ROI.

- Capital Growth: Dubai’s off-plan cycles drive fast appreciation; UK growth is slow and regulated.

- Taxes: UK stamp duty + income + capital gains reduce net returns. Dubai tax free investment lets income compound.

- Currency: AED pegged to USD offers stability vs GBP fluctuation.

- Population and Demand: Dubai’s expatriate population + tourism growth fuels rental demand.

- Supply: New master-plans create “early-bird” price entries UK markets lack.

These factors together explain why long-term capital appreciation in Dubai remains higher than in mature UK cities. When comparing UK vs Dubai property investment ROI, the contrast becomes clear — Dubai’s higher yields and tax-free growth significantly outperform the UK’s slower, regulated market.

Investor Insights 2025

For investors comparing UK property vs Dubai real estate, 2025 presents distinct choices.

1. UK — The Mature Market

London still leads for liquidity and safety, but its entry cost and tax burden are high.

Example: A 2-bed flat in London Docklands costs ~£600k with 2 % yield; in Manchester Ancoats, ~£300k with 4 % yield.

These figures suit institutional investors seeking slow, steady returns.

2. Dubai — The Growth Frontier

New communities like Emaar The Oasis, Palm Jebel Ali, and Dubai Creek Harbour offer entry from AED 1.6 M (≈ £340k).

Payment plans as low as 10 % on booking and 0 % tax on rental income make Dubai a strong case for portfolio diversification.

Dubai property for UK investors is increasingly popular because returns are both liquid and tax efficient.

According to the Dubai Land Department, British nationals were the third-largest foreign buyer group in H1 2025. (dubailand.gov.ae)

3. Diversification and Risk

While Dubai carries construction and currency risks, its tax-free environment and faster capital turnover justify a balanced allocation.

UK properties remain stable, but their ROI ceiling is lower.

A mixed portfolio can leverage both: UK for security, Dubai for growth.

4. What Investors Are Doing Now

We see UK investors selling one London asset to reinvest in two Dubai off-plan units. Example:

- Sell £700k London flat (yield 2 %) → Buy 2 x AED 1.2 M (≈ £520k total) Dubai apartments.

- Rental income doubles; tax drops to zero; potential ROI triples over 10 years.

Such moves highlight how Dubai tax free investment is becoming a strategic wealth-shift trend for global investors.

Conclusion — Who Actually Won?

Let’s add it up:

- UK Investor (1995–2025): ~4.5 % annualised ROI, stable, low risk.

- Dubai Investor (2010–2025): ~8 % annualised ROI, high yield, tax advantage.

The UK vs Dubai property investment ROI comparison shows a clear trend — Dubai offers faster, higher returns, while the UK provides long-term safety and currency stability. The Dubai investor gained more in less time, with lower taxes and stronger cash flow, while the UK investor benefited from stability and reliability.

Verdict: Dubai wins on ROI and growth; UK wins on security and predictability.

In 2025, the smart move is not either/or — it’s both.

Your Next Move

Thinking of diversifying beyond the UK market?

Get a free consultation on Dubai’s best projects for international investors.

We’ll review your UK portfolio, compare real returns, and show you how Dubai rental yields vs London yields perform side by side.

Our team specializes in matching UK investors to Dubai off plan investment returns that fit their budget and risk profile.

It’s simple, tax-efficient, and completely free to start — book your personal ROI review today and see how your capital can work harder in Dubai.